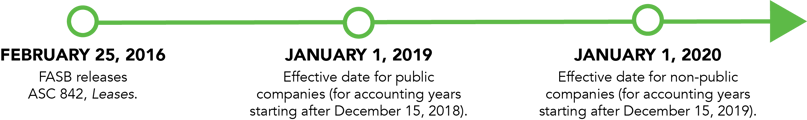

In February of 2016, FASB issued ASC 842, a new lease accounting standard that requires lessees to report assets and liabilities for leases of one year or more on the balance sheet.

The standard will impact nearly every aspect of lease accounting and all types of leases – from equipment rentals to real estate – and may involve departments across your company, including accounting, legal, IT, and procurement.

The timeline for implementation of ASC 842 is key, with varying dates for public and non-public companies. Public companies are up first with an effective date of January 1, 2019 (for accounting years starting after December 15, 2018). Non-public companies must comply by January 1, 2020 (for accounting years starting after December 15, 2019).

In this post, we’ll look at the common hurdles we have seen companies face when implementing ASC 842 and the steps you can take to ensure a smooth implementation.

ASC 842 Implementation Challenges

ASC 842 will dramatically change how companies handle lease accounting. Let’s take a look at the challenges of implementing ASC 842 and how to develop an implementation plan that overcomes them.

Assessing Your Current Lease Portfolio

Challenge 1: Defining a lease

Under ASC 842, even the definition of a lease changes. A lease is now an arrangement that conveys the right to “control” the use of an “identified asset.” Companies must now re-evaluate each existing lease as well as old and new contracts to see if they fall under this new definition. For companies with a large volume of leases and contracts, this can be a huge undertaking, as assessing and extracting information from a lease can take hours at a time.

Challenge 2: Locating a lease

The expanded definition of a lease means more documents to evaluate in more areas of your business. For larger companies this means going through AP ledgers, asset registers, vendor contracts, P-card purchases, financials, and more. For global organizations, this also includes leases in other countries that are in other languages, use different currencies, and fall under different jurisdictions.

Challenge 3: Identifying embedded leases

Finding embedded leases may be the biggest challenge when it comes to evaluating your current lease portfolio. Embedded leases occur when an implicit or explicit asset in a contract is controlled by the customer. Finding them within these contracts can be very time-consuming and require an expert eye.

Choosing a Leasing System

Challenge 1: Selecting and implementing an adequate leasing system

Up until this point, most accounting teams relied on Excel to track and manage leases, but the complexities of ASC 842 may require a more advanced system. Experts recommend implementing a dedicated leasing system to handle this. However, these systems vary in capabilities and knowing which ones your company will need can be challenging.

Challenge 2: Abstracting and entering leases into a leasing system

The new requirements of ASC 842 will change what information should be included in a lease abstract and will mandate more details to be included in the leasing system. Entering all your newly identified leases into the system will be a time-consuming challenge on its own, but this new level of detail will require even more time and effort.

Aligning with ASC 842

Challenge 1: Reporting on proper accounting treatment and disclosures

Leases that meet the new definition and criteria must be reported on the balance sheet and pertinent information must be included in disclosures to investors. Your team must take the time to completely understand what information needs to be included in the reporting and disclosure processes.

Challenge 2: Making appropriate updates to policies and procedures

Updating policies and procedures so they align with the new standard is a big project that requires a comprehensive understanding of ASC 842. Employees across the business will also need to be trained in these new changes.

Challenge 3: Finding the right resources

Much of the implementation process requires a strong knowledge of ASC 842 and advanced expertise in lease accounting. The team members managing the implementation must also be able to work with those across the business to gather and evaluate the information needed and train them in the new processes. Many organizations may not have the experts they need to manage a project of this size.

The Keys to a Successful ASC 842 Implementation

1. Start early

You may have noticed a common thread throughout many of the above challenges: implementation will require a significant amount of time. With less than nine months left until the effective date for public companies, now is the time to get started with ASC 842 compliance.

2. Develop a plan that extends into the future

The complexity of an ASC 842 implementation requires detailed planning at the start. Scoping appropriately, informing those who will need to be involved, and planning for a system implementation are all important elements of your compliance plan. But your plan should extend beyond implementation and establish processes for evaluating new contracts as they come in, entering new leases into the system, and reporting them properly.

3. Engage other departments early on

Many make the mistake of thinking changes to lease accounting will only impact accounting teams. Other departments, like IT, may have to assist with your leasing system implementation. Identifying these teams early on and notifying them of the changes to come (or their level of involvement) will help the implementation process run smoothly.

4. Take the time to choose the right leasing system

The success of your implementation hinges on choosing the right leasing system. After performing your impact assessment, take the time to build a scorecard and select a solution that meets the capabilities you need based on the types of leases you handle, your industry, your team’s abilities, and more.

5. Have GAAP and lease accounting experts on your team

A successful ASC 842 implementation will require experts in technical lease accounting and the requirements of ASC 842 and related FASB standards. This level of expertise may not be available on every team, depending on the size of the organization. Using an outside firm to provide lease accounting experts may be a more affordable option during the implementation phase.

A recent survey found that only 15% of companies had completed their ASC 842 implementation. The impact this standard will have on lease accounting processes across the enterprise means companies cannot hold off on implementation any longer. Focal Point has a team of lease accounting experts ready to talk to you about how to get started with your implementation.

Want more insights into updates like ASC 842?

Subscribe to Focal Point's Risk Rundown below - a once-a-month newsletter with templates, webinars, interesting white papers, and news you may have missed. Thousands of your colleagues and competitors have signed up! You can unsubscribe at any time.